BOSTON, MA – June 25, 2013 – Wide bandgap semiconductors – specifically, silicon carbide (SiC) and gallium nitride (GaN) – will lead the charge as the market for solar inverter discrete devices, driven by the downstream demand for solar modules, grows to $1.4 billion in 2020, according to Lux Research. That reflects a solid 7% CAGR, slightly lower than the 9% for all renewables and grid-based power electronics.

As devices featuring GaN and SiC hit the market, they’ll offer the biggest competitive advantage in small systems – microinverters and small string inverters, for residential and commercial solar installations – with a powerful proposition: lowering levelized cost of electricity (LCOE), and increasing margins on electricity sold through leases and power purchase agreements. They also will deliver improved performance and reliability.

“The holy grail for solar inverters is the implementation of wide bandgap semiconductors – specifically, silicon carbide and gallium nitride,” said Pallavi Madakasira, Lux Research Analyst and one of the lead authors of the report titled, “Reaching for the High Fruit: Finding Room for SiC and GaN in the Solar Inverter Market.”

“The performance benefits from both are such that inverter suppliers could charge a premium price and still achieve a significantly lower LCOE,” she added.

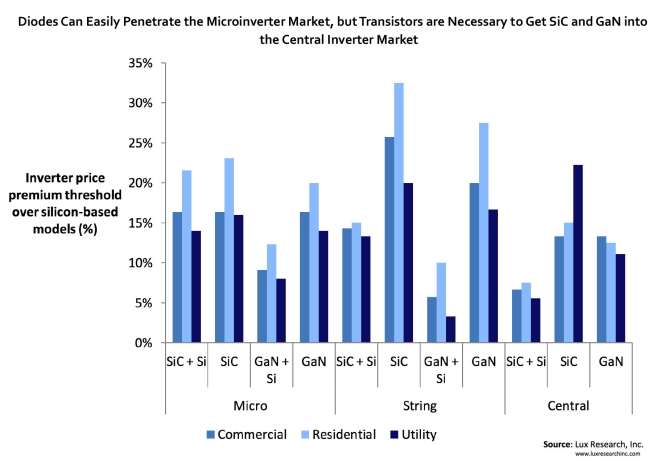

To understand the performance benefits of switching to GaN and SiC, Lux Research analysts modeled the three major types of inverters – microinverters, string inverters and central inverters – with Si, SiC, and GaN components. Among their findings:

• Higher efficiencies in smaller inverters. Power electronics with discrete devices made from GaN and SiC, rather than incumbent silicon, can increase efficiencies for solar micro- and string inverters to over 98%. The diodes increase harvested energy by more than 1.5% while the transistors can increase it by more than 4%. GaN-on-silicon offers the lowest cost solution while GaN-on-SiC and SiC-on-SiC offer far superior efficiency.

• Microinverters will command highest premiums. SiC and GaN have the greatest price premium power (>$0.10/Wp) in microinverters, without increasing LCOE. Though a niche solution, the microinverter segment is also an attractive segment for SiC and GaN to see early adoption and ramp up volumes.

• Indirect benefits add to the value proposition. GaN and SiC also result in indirect cost savings in the form of a reduced failure rate of passive components, footprint reduction and savings in installation cost. Also, their superior thermal conductivity reduces the size of the heat sink in inverters.

• Industry consolidation is near. After an industry shakeout, companies like SMA and Power-One that took an early lead in SiC technology are well-positioned with negligible debt. Consequently, start-ups like Enecsys and mPowerSolar are under pressure to either implement SiC or GaN and absorb the extra cost, or lose their foothold in the market.

The report, titled “Reaching for the High Fruit: Finding Room for SiC and GaN in the Solar Inverter Market,” is part of the Lux Research Energy Electronics Intelligence and Solar Systems Intelligence services.

About Lux Research

Lux Research provides strategic advice and ongoing intelligence for emerging technologies. Leaders in business, finance and government rely on us to help them make informed strategic decisions. Through our unique research approach focused on primary research and our extensive global network, we deliver insight, connections and competitive advantage to our clients. Visit www.luxresearchinc.com for more information.