Paris, France, November 27, 2013 – Bioaxial, developers of super-resolved fluorescence microscopy for the extended imaging of live cells, today announces the completion of a EUR 1.9 million (USD 2.7 million) equity investment by three new large investors; Amorcage Technologique Investissement (a fund managed by CEA Investissement), Inserm Transfert Initiative and Viveris Management plus a range of individual investors.

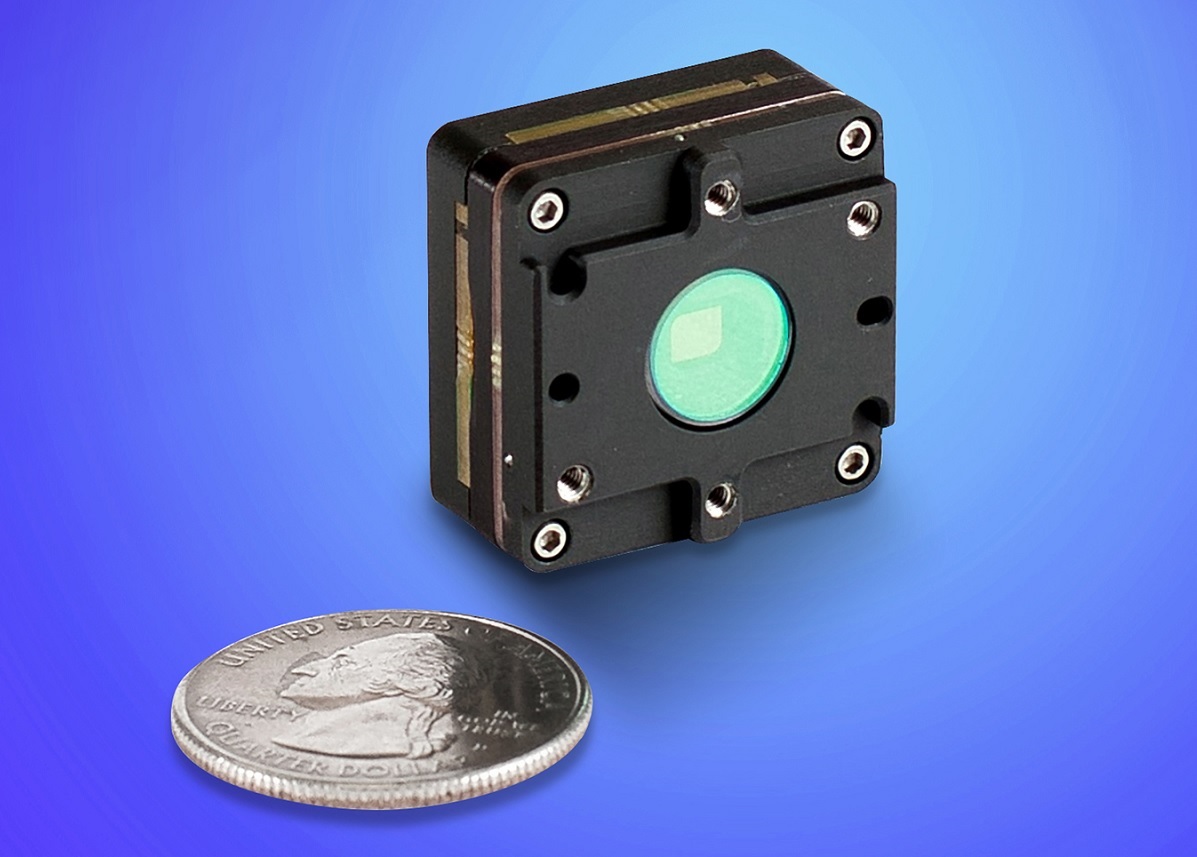

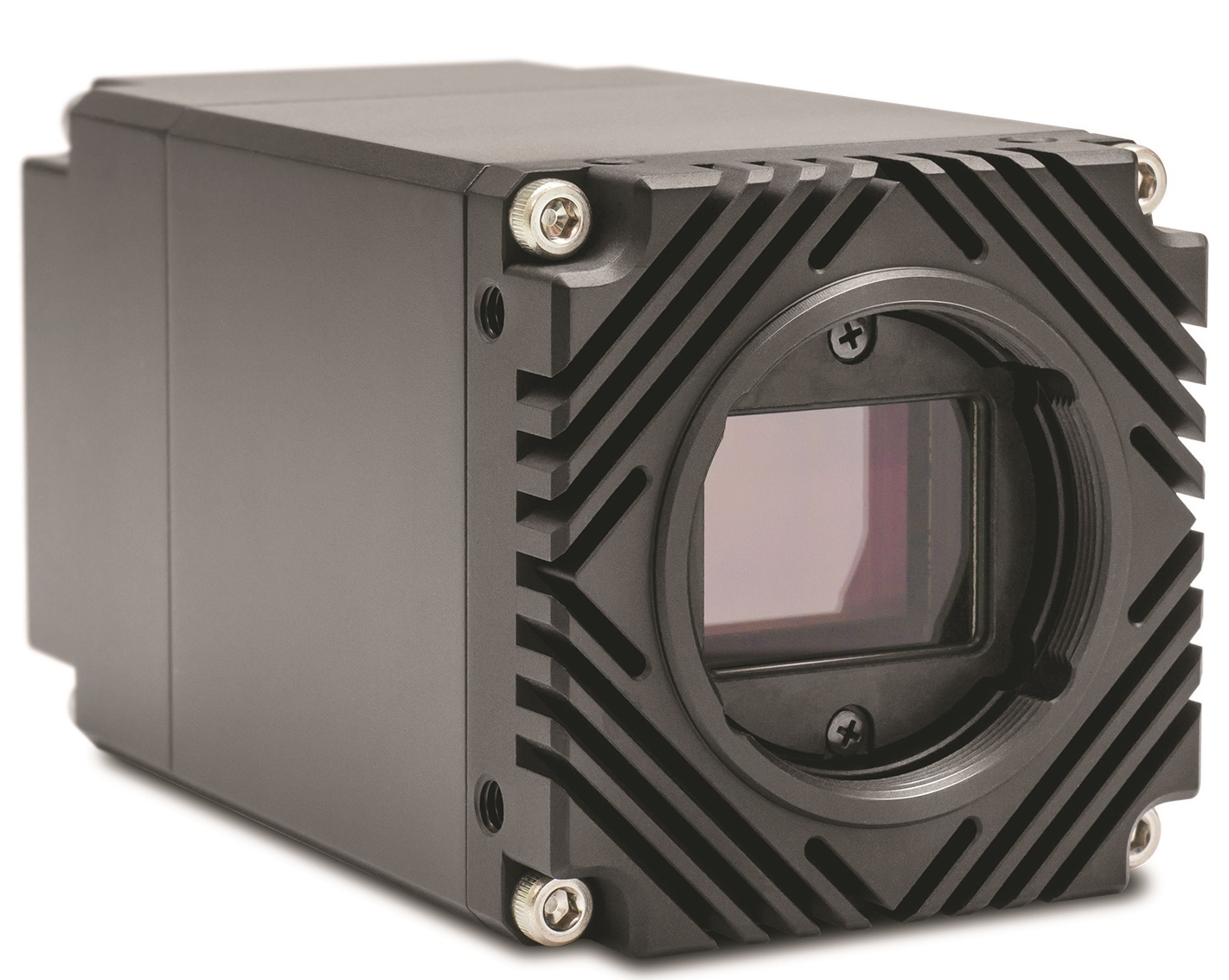

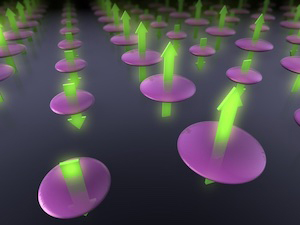

This capital, from specialized funds for seed investment in young startups will back the commercial launch of Bioaxial’s first product, an optical microscopy module, which is expected in the second half of 2014. Bioaxial is developing imaging instruments for fluorescence microscopy that allow extended imaging of live cells with an improved resolution so far unreachable in research laboratories. This innovative module not only allows observation of living cells in super-resolution over time without damaging them, but unlike its competitors, does not require complex manipulations. It has been tested at the Institut Pasteur for the last 12 months. The founders of Bioaxial are experts in the industrialization of innovation and have an international track record in the semiconductor and optics industries.

“The investment of funds in Bioaxial’s capital is a vote of confidence in the team and its technology. It is a strong signal for the targeted market segment. It brings us credibility and allows us to launch commercially,” said Louis Philippe Braitbart, CEO and co-founder of Bioaxial.

“Our technology revolutionizes optical microscopy in the life sciences market”, said Gabriel Sirat, CTO, co-founder and inventor of the technology. “We expect applications in many areas where improved resolution is essential to better understand the processes of live entities.”

“We enthusiastically support Bioaxial in the commercial launch of its first product. Their technological breakthrough delivers strong differentiation to its first range of instruments,” said Celia Hart, investment director at CEA Investissement. “The key gains are in terms of resolution, the ability to image live cells, ease of use and in cost. The management team also has extensive experience in the development of instruments all the way to the market.”

“This is our second investment in medical device instrumentation,” said Matthieu Coutet, managing director at Inserm Transfert Initiative. “We were very impressed by this ambitious project, which brings together an experienced team, a disruptive technology and clearly identified business opportunities.”

“I look forward to our entry into the capital of this young company whose innovative products have strong international market potential,” said Jerome Feraud, investment director at Viveris Management.

About Bioaxial http://www.bioaxial.com

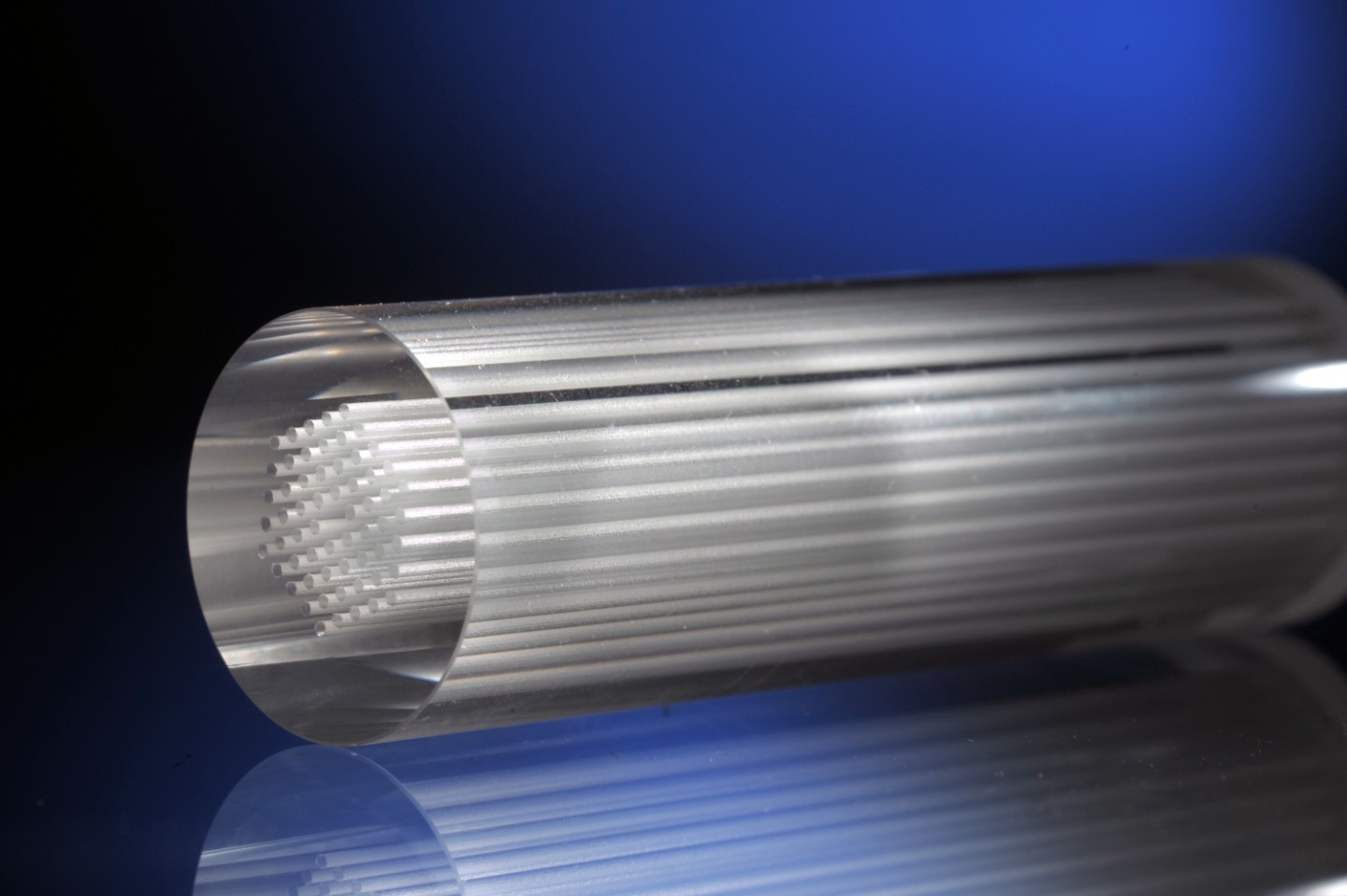

Bioaxial develops new technology for super-resolved fluorescence microscopy for extended imaging of live cells with a resolution of less than 100 nanometers. The optical modules manufactured by Bioaxial adapt as an add-on for commercial microscopes. Bioaxial has filed four patents and has acquired a fifth, all of which are held exclusively by the company.

Bioaxial, founded in 2010, is headquartered in Paris and employs five people. It was founded by Gabriel Sirat and Louis-Philippe Braitbart who both trained as physicists and have international careers in the semiconductor and optical metrology industries.

About CEA Investissement http://www.cea-investissement.com

CEA Investissement, a subsidiary of the CEA, is a specialist in seed investment for technology companies. Its proximity to public research laboratories and the venture capital industry has made it a key player in launching and financing startup companies in France. To date it has funded over 50 companies. With 15 years of experience in seed investment, CEA Investissement has developed a method of investing and monitoring that has generated several successful outcomes, such as the companies TRACIT and ULIS. The investment in Bioaxial was made through the ‘Amorcage Technologique Investissement’ (ATI) fund, managed by CEA Investissement. The CEA, BPI (using the FNA), EDF, SAFRAN and BIOMERIEUX are investors in ATI.

About Inserm Transfert Initiative http://www.it-initiative.fr

Inserm Transfert Initiative is the first seed investor in life sciences backed by a public entity. In 2012 it was funded with EUR 35.5 million, dedicated to funding the initiation of young innovative companies in the biomedical field. At its inception in 2005, Inserm Transfert Initiative brought together four equal players in financing startups in biotechnology: Inserm Transfert SA, Natexis Venture Selection, Sofinnova Partners and CDC Entreprises, especially since 2012 with the FNA (Fonds National d’Amorcage) that the CDC manages on behalf of the French government. Inserm Transfert Initiative supports entrepreneurs in biotechnology in the early stages of their business development.

About Viveris Management http://www.viverismanagement.com

Viveris Management is a major player in capital investment. It manages funds invested in SMEs located in the French regions, overseas and around the Mediterranean. Since its inception in 2000, Viveris Management funded 250 companies with nearly EUR 650 million subscriptions across a broad range of investment vehicles including public funds (FCPI, FIP) as well as funds for qualified investors (FCPR with simplified procedure). Viveris Management has been a member of ACG Group since December 2011.

Bioaxial secures EUR 1.9 million (USD 2.7 million) in new funding to finance the commercialization of its first range of super-resolved fluorescence microscopy instruments

The young Parisian firm will market its imaging instruments to the life sciences sector within twelve months

Mr Braitbart, CEO of BioAxial.